Retirement can be tough for many people because expenses rise while income often decreases. The Workfare Income Supplement (WIS) helps to ease these challenges by providing extra financial support. This article explains everything about the Workfare Income Supplement 2024, including payout dates, eligibility, amount, and how to apply.

Workfare Income Supplement 2024

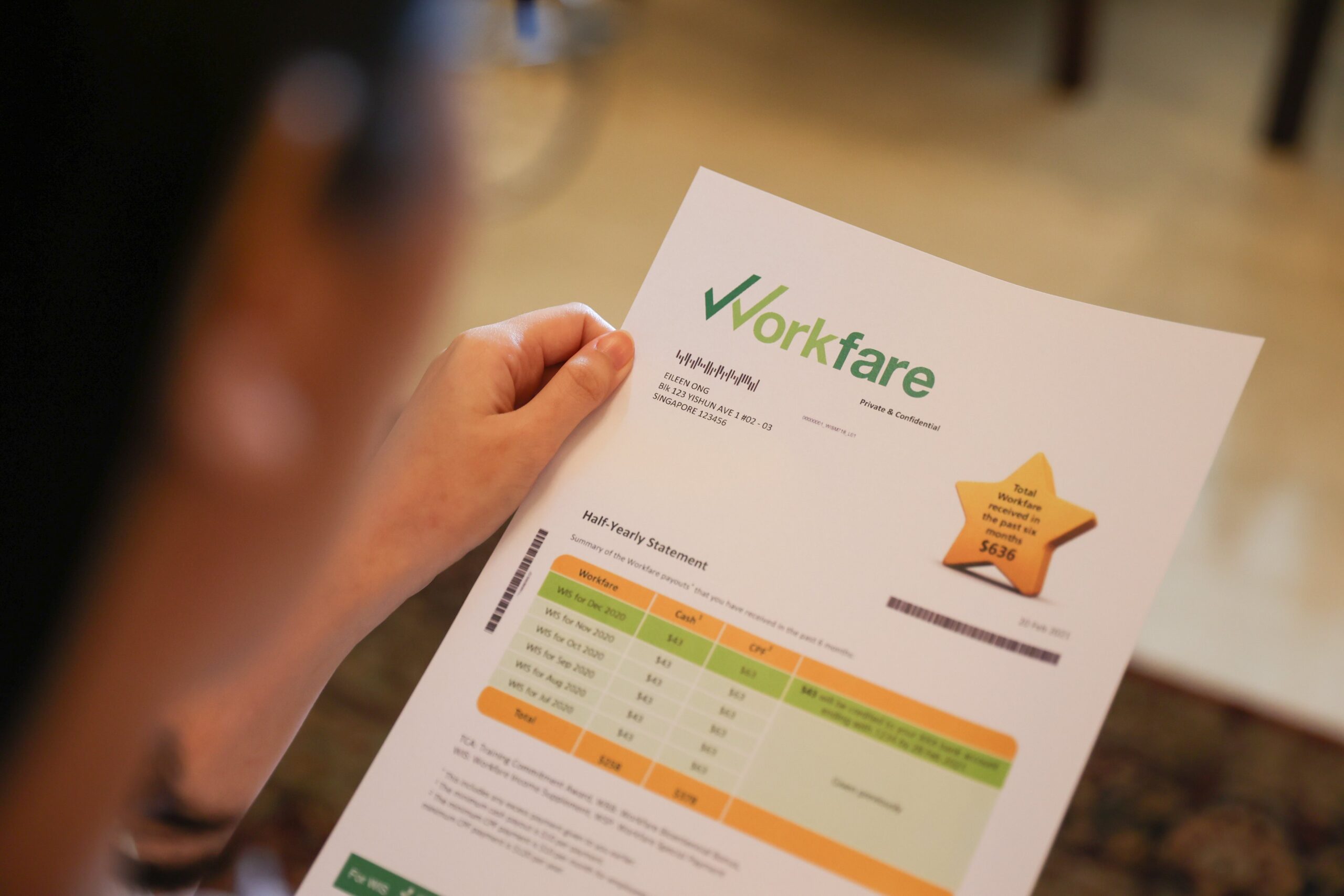

Workfare Income Supplement (WIS) is a program in Singapore designed to help low-income workers by topping up their salaries. This program, introduced in 2007, encourages people to work and upskill by providing additional income. It aims to support about 20% of the population who earn below a certain amount.

Why Workfare is Important?

In times of high inflation, living costs go up, and many people struggle to save for retirement while taking care of their families. Workfare helps by providing extra money to those who need it most, ensuring they can meet their basic needs and save for the future.

IMPORTANT:

- Cost of Living Special Payment 2024

- How To Make $100 a Day in Singapore

- Singapore’s Workfare Special Payment 2024

Workfare Income Supplement Payout Dates 2024

The payout dates for WIS vary depending on whether you are an employee or self-employed:

- Employees: The WIS amount is paid monthly. You can expect your payout at the end of each month.

- Self-Employed: The WIS amount is paid annually. There isn’t a fixed schedule for this, but you can expect your payout by the end of February or early March.

Disabled individuals receive additional support, with payments typically processed on the same day they are disbursed. However, direct deposits might experience slight delays due to heavy traffic on the network.

Workfare Income Supplement Eligibility 2024

To qualify for the Workfare Income Supplement, you must meet certain criteria:

- Age: You must be at least 30 years old.

- Employment: You must be working as a regular or full-time employee.

- Residency: You must be a habitual resident of Singapore and provide proof of residency.

- Income: Your monthly income should not exceed SGD 2,500.

- Disability: Disabled candidates must provide medical documents to verify their condition.

- Training: You must have completed WSQ or academic CET training worth at least SGD 800.

- Tax Returns: Ensure all your previous year’s tax returns are filed.

Workfare Income Supplement Amount 2024

The amount of WIS you receive depends on your age, employment status, and salary. Here’s a breakdown of the expected amounts for 2024:

Employees:

- Ages 30-34: SGD 2,100

- Ages 35-44: SGD 3,200

- Ages 45-55: SGD 3,600

- Ages 56-60: SGD 4,200

- Above 60: SGD 4,200

Self-Employed:

- Ages 30-34: SGD 1,400

- Ages 35-44: SGD 2,100

- Ages 45-55: SGD 2,400

- Ages 56-60: SGD 2,800

- Above 60: SGD 2,800

Additionally, caregivers receive SGD 500 per quarter as a supplemental allowance. Typically, 40% of the WIS amount is given as a cash deposit, and the remaining 60% goes to the NRIC account.

How to Apply for Workfare?

Employees: You do not need to apply for WIS. Your eligibility is automatically calculated based on the CPF contributions made by your employer. If you qualify, you will receive an approval notice.

Self-Employed: You must report your income to the IRAS and contribute to your MediSave Account. Ensure your NRIC account is linked to your bank to avoid delays in receiving payments.

Conclusion

The Workfare Income Supplement (WIS) provides essential financial support to low-income workers in Singapore, helping them manage living expenses and save for retirement. By understanding the eligibility criteria, payout dates, and amounts, you can make the most of this beneficial program. For more detailed information, always check the latest updates from the official sources.